Without Deloitte Support

What do I

need to do?

Click on the moons on the right to read more about what action you need to take and when to take it.

Click on the moons on the right to read more about what action you need to take and when to take it.

| Date | Event |

|---|---|

| By 1 March | Your employer is required to electronically transmit your remuneration details to the IRAS under the Auto-Inclusion Scheme (AIS) for the preceding calendar year. |

2 March to 18 April |

|

18 April |

|

| Generally, within 1 to 2 months from the filing of tax return |

|

This section is relevant if you are a non-Singapore citizen (including SPR) who is ceasing Singapore employment (including on overseas assignment for more than 3 months).

The employer is required to seek tax clearance (Form IR21) for you if you cease employment in Singapore, go on an overseas posting or plan to leave Singapore for more than 3 months.

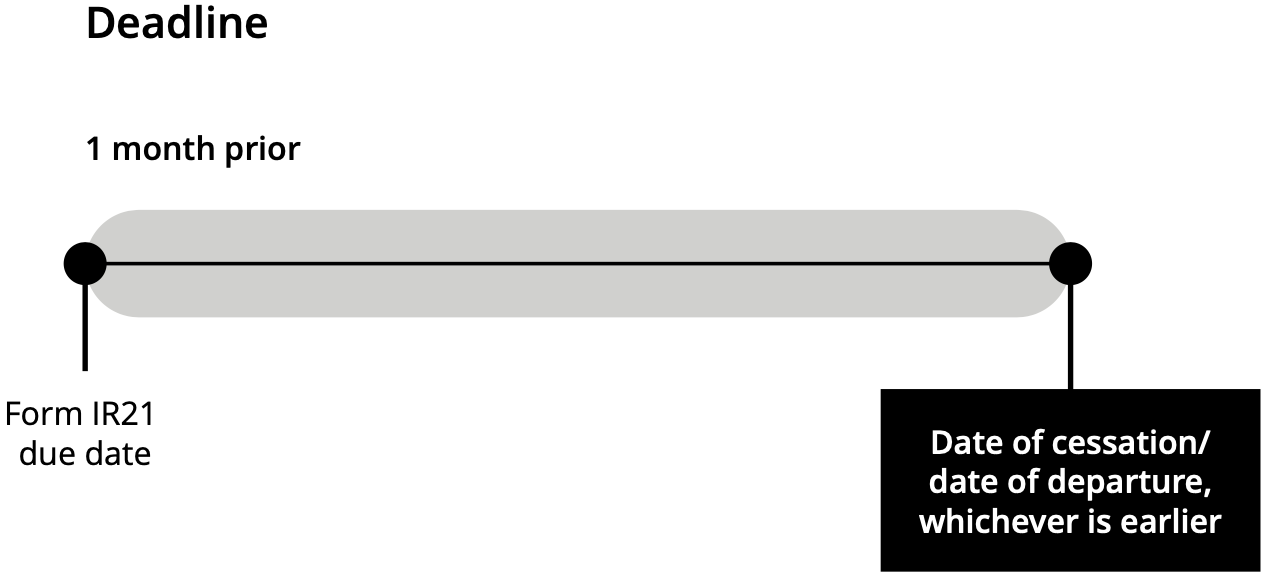

Please see the graph opposite for the deadline of the Form IR21 filing:

Employer is required to withhold all monies due and payable to you until the expiry of 30 days after the receipt by the IRAS of a timely filed Form IR21 or tax clearance notice given by the IRAS.

An additional Form IR21 must be filed by the employer with the IRAS to report any post-cessation income (e.g., bonus, etc.) or benefits relating to the Singapore employment. Monies are also required to be withheld pending the additional tax clearance.