With Deloitte Support

What do I

need to do?

Click on the moons on the right to read more about what action you need to take and when to take it.

Click on the moons on the right to read more about what action you need to take and when to take it.

It's important to keep your Deloitte Calendar up-to-date at all times. This is used by the Deloitte team in Singapore and in any other countries in which Deloitte is supporting with your compliance requirements.

The calendar:

Click here to view how to complete your GA calendar.

Keeping your Calendar up to date ensures we correctly assess your Singapore tax residence position and can determine the taxable portion of your pay that needs to be reported in Singapore. You should continue to use the Calendar until 31 December (the end of the tax year) even after your assignment ends to ensure all the required information is in one place before your Singapore tax return is completed.

It's important to retain all relevant records for the period you're working in Singapore. These include:

These records may be required for accurate completion of your Singapore tax return and will be needed if IRAS should decide to audit your tax return.

These records should be retained for at least 4 calendar years after the year in which your Singapore tax return is filed.

| Date | Event |

|---|---|

| January / early-February | Deloitte will issue Tax Data Organiser (TDO) and calendar for your completion. |

| 28 February | Complete TDO and calendar. |

18 April |

|

| 1 March to 30 June | Deloitte to prepare the tax return and the completed package will be sent to you and the company for approval before submitting to the IRAS. |

| 30 June |

|

| 1 July to December |

|

This section is relevant if you are a non-Singapore citizen (including SPR) who is ceasing Singapore employment (including on overseas assignment for more than 3 months).

The employer is required to seek tax clearance (Form IR21) for you if you cease employment in Singapore, go on an overseas posting or plan to leave Singapore for more than 3 months.

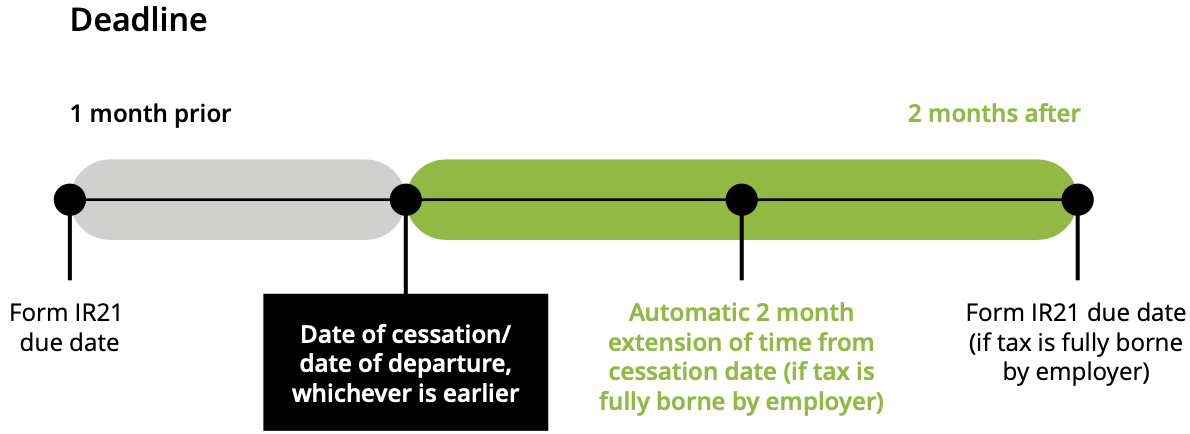

Please see the graph opposite for the deadline of the Form IR21 filing:

Employer is required to withhold all monies due and payable to you until the expiry of 30 days after the receipt by the IRAS of a timely filed Form IR21 or tax clearance notice given by the IRAS.

An additional Form IR21 must be filed by the employer with the IRAS to report any post-cessation income (e.g., bonus, etc.) or benefits relating to the Singapore employment. Monies are also required to be withheld pending the additional tax clearance.